Quickly writing this down waiting for the coffee to kick in.

So about an hour ago China’s 1Q GDP was reported at 8.1%, expected at 8.4% and previous 8.9%. Got a short 50 pip scalp on AUDUSD, but paid it back with a more sizable technical-led position on AUDNZD (bottom of a 3 year channel).

China’s growth can be attributed as the cause of the relative strength of the Australian dollar (hot flows causes growing industries, and relatively tight rates to normal growth compared to other countries). That explanation can go on for pages, but the general consensus is that since 2007 or so, China has been driving Australia.

And when the CNH market opens, there might be a fundamental shift…

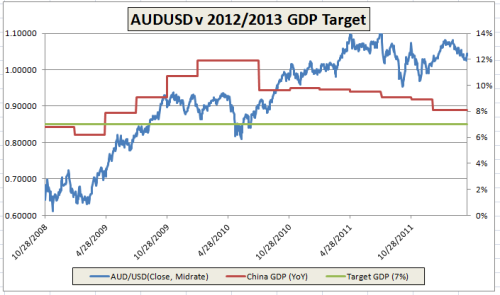

But here’s what we’re looking at. Remember that Premier Wen has set a 7.5% GDP target for 2012/2013, but a 7% line is more likely before the PBoC/Government starts looking at other policies (ie easing again).

Basically there you go. No commentary that I can think of…

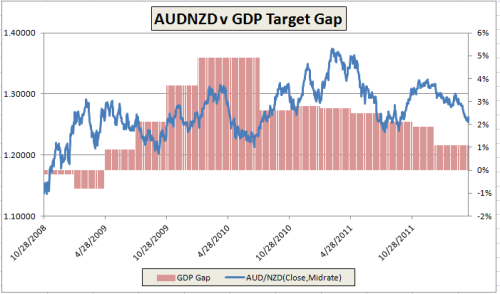

But the next question is does weaker Chinese economic performance hurt the AUD or NZD more? There’s arguments on both sides, as the two nations provide different types of goods to China (hard and soft commodities). Could AUDNZD be driven by something more than rates, meaning is one country more dependent on China on the other?

No, it’s still driven by individual rates. Take out the Chinese effect ant the rate gap between Australian and New Zealand is still very much dependent on domestic economic strength. Now, which domestic sectors are more affected by outside influence, that is harder to do without a Bloomy terminal. But I would separate growth by sectors, compare growth rates, and then see if they match up to what China demands from them.

Also, I’ve included the data in the end. Run it with gretl or any other lab and you can see the correlations oscillate with any timeframe. Sell both against the buck if you have to. (Also, AUDUSD 1d shows yesterday’s close closing right at the bottom of the cloud. 1 day reversal? I’m hedged in).

Yeah… that analysis had almost no value but at least I knocked it out quickly. There was an interesting read a few days ago on Zerohedge on the introduction of treasury floaters (more market guided debt issuances) and possible signals the Fed is giving.

AUD-CNGDP

To the best of good buys.

Read Full Post »