It seems like the market has reached a point of fatigue with regards to the Greek situation. The easiest situation would be of course for Greece to “restructure” or have lenders receive a haircut. Of course, this will be not just detrimental, but fatal to the Eurozone and Großdeutschland’s political dream of creating perhaps the first actually working European single currency (unlike the Latin Monetary Union or the Scandinavian Monetary Union.)

And that’s why instead of using that rhetoric of “restricting” we have “profiling” and “bailouts” to “support and Germany is at the forefront of throwing everything they have at Greece and now the other peripherals.

But the start of the crisis was early 2010 with the first Greek austerity measures. Since then, central banks, markets, and now even absolutely useless rating agencies are joining the fray, bringing confusion, risk, and a whole lot of volatility into the Euro. And the Euro’s not feeling well.

But 2 years later, is the market becoming fatigued? The Euro right now is 1.4200 or so against the buck which is only a bit off from its pre-recession high in the late 2009 when easy injections into the system restored confidence – and gave people reasons to believe the housing crisis was only a blip on the radar. The Euro dropped in mid-2010 when more news hit the wires and the press started to blow out the story.

Yes, that followed fundamentals – but the question now is whether or not the Greek crisis (and Portuguese, Irish, maybe Spanish and even Belgian or Dutch) still matter to investors, or will the rhetoric of Merkel and co. keep those fears at bay.

Maybe the Euro will become a new dollar. Maybe it will end the rout of the LMU.

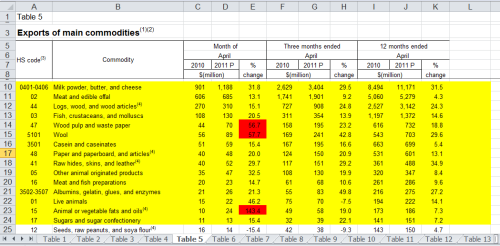

Here’s a breakdown of major political events in the peripheries since 2010, and a chart.

Weekly chart with some bits of the recession

2010 Feb 02 GR First round of austerity outlined – including raise on fuel taxes

2010 Feb 03 GR EU/EP endorses Greek plans to raise taxes and cut spending

2010 Feb 03 ES Spain heightens deficit to 9.8% of GDP in 2010, decreasing to 3% in 2013

2010 Feb 09 GR The powerhouse mentions “loan guarantees” to calm default fears

2010 Feb 11 GR Reports leaders have forged deal to help Greece deal with crisis

2010 Feb 15 GR Greece demand to show balanced budget or face tax demands

2010 Feb 17 ES Spain sells EUR 5 billion in bonds at 5.7% – jitters haven’t hit Spain yet

2010 Feb 23 GR Fitch downgrades major banks to BBB, outlook negative

2010 Mar 03 GR New austerity plan announced, may yield EUR 4.8 billion savings

2010 Mar 04 GR Civil unrest starts protesting cuts

2010 Mar 04 GR Trichet promises Greece would not need IMF support

2010 Mar 08 PT New budget includes array of cuts, caps and tax increases

2010 Mar 16 GR S&P holds Greek bond ratings at BBB+, says no need lower

2010 Mar 18 GR Papandreou asks EU for “standby loans,” prefer EU to IMF

2010 Mar 24 PT Fitch drops Portuguese bonds to AA-, warns caution

2010 Apr 06 GR Greek government 2 year debts hit 7.1% record

2010 Apr 09 GR Fitch cuts Greek debt to BBB-, outlook still negative

2010 Apr 22 GR Eurostat says government deficit in 2009 was wider, at 13.6% GDP

2010 Apr 22 GR Moody’s is late to the part by lowering bonds from A3 to A2

2010 Apr 23 GR Greece asks for aid from the EU and IMF (EUR 45 Billion bailout)

2010 Apr 27 GR S&P cuts Greek debt to junk levels

2010 Apr 27 PT S&P cuts Portuguese bonds to A-

2010 Apr 29 GR Government agrees to further EUR 23 billion to get bailout

2010 May 01 GR Deal reached for EU bailout mechanism, EFSF comes into shape

2010 May 05 EU EURUSD hits 1 year+ low at 1.235 levels

2010 May 07 GR German lower house approves ~EUR 22 billion loan to Greece

2010 May 10 EU EFSF sets aside EUR 750 billion for bailouts

2010 May 21 ES Banco de Espana takes over CajaSur – cajas targeted

2010 May 29 ES Fitch lowers Spanish debt rating to AA+

2010 Jun 17 EU Stress tests planned for all Eurozone banks

2010 Jul 19 IE Moody’s drops Ireland’s credit rating on debt, to Aa2

2010 Jul 23 EU Stress tests released, show 5 Spanish banks need more capital

2010 Sep 30 IE Government reports collapse of banking sector will be devastating

2010 Oct 18 EU DE, FR say permanent bailout fund can cost bondholders

2010 Oct 26 IE Government says austerity of EUR 15 billion over 4 years needed

2010 Nov 21 IE Ireland says it has applied for an EU and IMF bailout

2010 Nov 22 IE Political cracks seen as citizens lose confidence, election proposed

2010 Nov 24 IE EUR 15 billion austerity over 4 years outlined

2010 Nov 28 IE Ireland receives EUR 67.5 billion bailout

2010 Nov 29 EU Euro ends stronger, though drew lower for early part of week

2011 Mar 07 GR Moody’s lowers credit rating to Ba1 from B1

2011 Mar 11 EU Leaders agree to plan out permanent EUR 500 billion fund starting 2013

2011 Mar 24 PT Fitch lowers rating to A-

2011 Mar 29 PT S&P lowers rating to BBB-

2011 Mar 29 GR S&P lowers rating to BB-

2011 Mar 31 GR S&P, Fitch keep cutting like Walmart, markets ignore peanut gallery

2011 Apr 18 PT EUR 80 billion announced

May wasn’t that big, although the key word that has developed was “re-profiling” – basically extending Greece’s problem rather than paying it off. Furthermore, some shoots are showing as the Greek government agrees to sell some of their assets – including stakes in national companies, though this is not enough to even pay back their borrowing

And just today, reports are coming in that Greece has missed fiscal targets set by bondholders including other Eurozone nations and the ECB, although the government (what else can they say?) has fervently denied it.

Of course, news has died down, coming into the summer months as investors shift their focus to the US as the last round of QEII purchases and related actions are due to end June 9th. There are concerns the US economy might slow, but that hasn’t made sense in the markets as the Euro has gradually strengthened. Yet, the end of QEII and the direct increase in rates are still unclear, and from the way the US economy is at, might take up to a year, while Trichet has been repeated stamping his German-made “price stability” jackboot into the face of the peripheries.

And we know Germany will try to do everything to preserve this financial project to preserve its political dreams. The risks of a Greek default, although possible is still quite slim because once again, this is a country, and the shock of one country going belly-up will certainly take the wind out of investors. It’s not really a question of if right now, but more how long can Greece be dragged along the asphalt?

I personally think the Euro has no reason to be this strong right now against the dollar given all its inherent risks. But the only real reason for its strength is due to its higher yields and even higher yield expectations. German manufacturing and industry has been lower (or slower growing) for the past two reported months, and France is still stagnant. With politics spilling over into economics, future bailouts and “relief” would be even harder. In the coming summer months, consumption might drop further.

Also, I wouldn’t bet too much against a later-year US recovery. Barry wants to get elected and although he got BL, he can’t go on that momentum forever.

But maybe not China. Chinese demand for whatever heavy German machinery and technology has to offer has been bouying its economy, and in a way replacing the demand that would have otherwise come from the United States. Not forecasting a bubble popping – but PBoC Governor Zhou Xiaochuan has repeatedly stated they might raise reserve requirements and interest again (two or three times) to slow inflation. Industrial profits, although still at an amazing 29% over 3m, has dropped from the previous ~36%.

And the PBoC always looks at overall, especially food prices as energy is subsidized somewhat. Here’s the latest report in over 50 large cities. Around a 3% increase in the price of pork and almost 12% in napa cabbage (which has been one of the fastest rising foods in China)? I bet the PBoC is watching.

And when is the 2nd series of Euros coming out? They said early 2011! Why haven’t I seen any designs?

Also, what is this? China looking to buy EUR, NZD, AUD denominated bonds? Sure, that’s developing a market, but if the big panda really enters the room that way, the USD might be doomed.

But we are the biggest economy in the world. nah, I think I’m going to listen to interest rates instead.

Entry buy USDJPY at 81.20, then 80.80.

Entry sell EURUSD at 1.4550.

To the best of good buys.

Read Full Post »

I slept at 6 this morning after watching the Hangover II and I’m frying.