So full of naive analysis it must be split into 2 parts!

My view: there will most likely be a downgrade of US ratings, but unlikely to be a default. This continuation will most likely still continue, with flows out to every other currency possible despite the well-clear risk aversion moves. However, watch for extreme pressure building up in the dollar pairs (which basically is every pair out there).

The US dollar is (up to 2 weeks ago) a safety currency, moving opposite of risk appetite assets, most notably stocks – the S&P500. Thus, when stocks move higher, the greenback moves lower as traders shift money into slightly more risky and higher yielding assets, usually denominated in another currency.

That is, until last week when the uncertainty started to emanate from the US. This is almost a deja-vu with the Euro when the Greek problem was at a fever pitch – moving downwards no matter how much risk sentiment improved.

With the virus effectively shifted from the EU to the US, it’s interesting to take another look at how much the USD has decoupled with its usual “haven” status. /JPY and /CHF pairs correlations haven’t really been hit because of course, the problem isn’t there. This post will focus only on the buck.

===

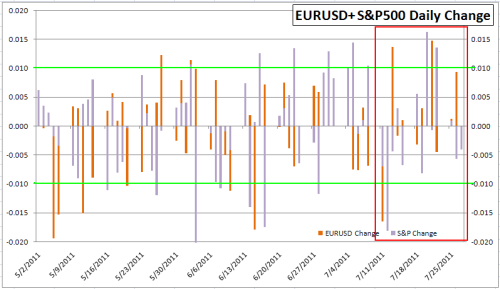

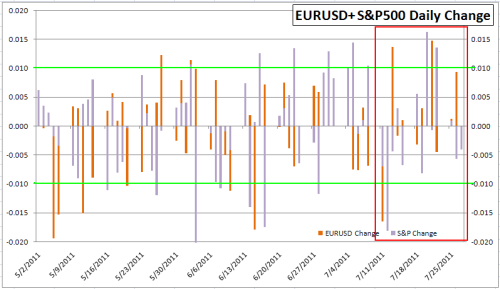

The first chart to start – EURUSD and S&P500. These two are supposed to be positively correlated, and offer a good insight as it is the most liquid pair in the market. The timescale is also a good view as May/June were the last gasps of Greece, and early July showing our current problem.

k – so the decoupling for this story can be seen for the data at around this week, basically the past 5-10 trading days. The S&P500 and almost every other world index fell – but the Euro strengthened! There is no explanation for this except people were just basically selling the dollar enmasse, putting their cash into anything – including the next best (liquid) thing, the Euro.

All right then, let’s look at the short term correlations between the two…

Nothing much, really to say. The important thing is to look for negative correlation in both weekly and biweekly rollings. errr, not that much… but maybe because they’re rolling.

Here’s a much more… intensely correlated chart.

What we’re looking for here is a daily change over 1% for both assets, in the opposite directions, but more so in EURUSD gain while the S&P500 falls.

ahh… much more instances of EURUSD+ and S&P500- in quite grand scares, especially in the past week.

This decoupling is something to take for real consideration and impact – even with the Euro, a currency with so much fundamental problems of its own, the dollar is losing ground. Even with risk aversion, the dollar still refuses to budge higher, with investors recognizing that the loss is from the USA and trying to get away from it in any way possible.

So what could this mean? The first is that pressure is building up. The currencies markets may be reading into it way too much that the US government may default. Although that is very unlikely as that will basically be an excuse for all of America’s debtors especially this one, to invade, what is almost certain is that a rating agency will downgrade the US credit-worthiness.

There will be almost an immediate shock to the dollar – like what we saw with the Greek downgrades, which could provide for an attractive scalp. However after that? There will probably be higher yields, which would cause the unwinding of dollar-funded carries (and no-one knows how big that pot is right now), thus provoking buying of dollars. Additionally depending on the correlation, the USDJPY may finally see some upside life, though of course after that heavy fall.

One more thing about yields: because many funds and governments (except the Bank of Korea, for one) prevent the holding of any assets rating under AAA, the dumping of US bonds will lead to higher yields. Though the dumping will result in lots of dollars entering the market, the yields and flooding may result in the yields winning out.

So until then, it’s best to stay out of the market. I will definitely consider closing some of my smaller losing trades or depositing more if USDJPY does decide to plummet.

By the way, here’s FRA-OIS/Liquidity for the USD and EURUSD. Same thing as the S&P500 during the past week – higher liquidity but higher EURUSD? Not natural!

Here are a few other charts – including FRA-OIS and the full set for AUDUSD deco2

Until then, don’t expect the congress of morons to do anything much.

To the best of good buys.

Read Full Post »